Bondsupermart Malaysia has received the approval-in-principle from Securities Commission Malaysia to operate a bond marketplace.

The subsidiary of SGX-listed iFast Corp aims to launch its bond trading services in Malaysia in the second half of 2024.

In an announcement on Jan 20, iFast says Bondsupermart Malaysia wants to be a “centralised and easily accessible marketplace to buy and sell bonds.”

It will tap on this accessibility to transcend geographical boundaries and connect individual investors, creating a global marketplace for all to participate in both the Malaysian Ringgit and the global bond market.

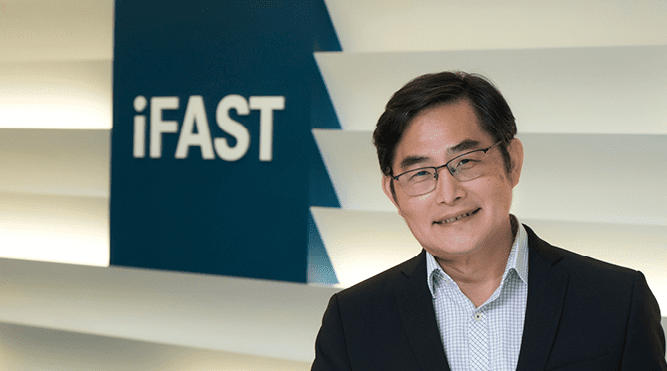

Lim Chung Chun, Chairman and CEO of iFAST Corp, drawing on the company’s experience offering individuals to trade bonds in Singapore, Malaysia and Hong Kong since 2015, observes that the bond market has not seen much innovation over the past decade.

In contrast, other segments of the securities markets have undergone improvements propelled by technology whereas bond trading for individual investors is still inefficient, given how the predominant way is via over-the-counter as there are currently few to none exchanges for bond trading for individual investors.

“As such, bond investors are unable to enjoy price transparency and trading efficiencies experienced by stock investors who trade via stock exchanges,” says Lim.

According to Lim, iFast Corp as a whole now handles bond trading volume of approximately RM800 million equivalent per month in both the ringgit and foreign currency-denominated bonds.

With this base, Bondsupermart Malaysia will enjoy a “solid footing” to attract, grow, and expand further when more participants are onboarded in future,” says Lim.

The Bondsupermart platform offers real-time price discovery and will be able to establish market-driven and fair market values for bonds based on supply and demand dynamics.

“In today’s market environment where interest rates have come up, bond returns have become more attractive and will increasingly become an important asset class in an investor’s portfolio,” says Wong Tze Hong, executive director of Bondsupermart Malaysia.

“In markets including Malaysia, market liquidity for bonds has always been an important topic. The new bond marketplace will be the closest to a bond ‘exchange’ for individual investors.

“By connecting a greater number of buyers and sellers, and having dedicated market makers to come onboard, it will contribute to enhanced market liquidity that will result in faster execution of trades and narrower bid-ask spreads, ultimately reducing investors’ trading costs and improving the efficiency and overall functioning of the bond market,” adds Wong.

iFast shares closed at $7.85 on Jan 19, down 0.63% but up more than 50% over the past 12 months.

Source: theedgesingapore.com

Leave a Comment