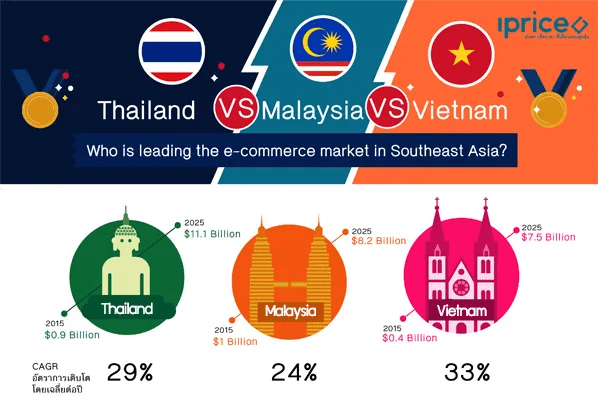

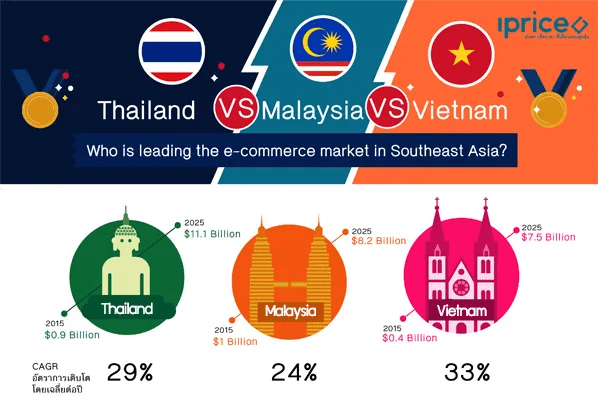

Thailand is expected to be the second biggest e-commerce market in Southeast Asia in 2025

According to the e-conomy SEA study by Google and Temasek, it shows Thailand e-commerce market value was $0.9 Billion in 2015.

It projects that the market will grow with the compound annual growth rate of 29% which will reach the valuation of $11.1 Billion in 2025, expecting it to be the biggest among the three countries and become the second largest in Southeast Asia after Indonesia.

This supports the fact that Thailand has a high potential to be a hub for e-commerce and e-payment in Southeast Asia, according to Kulthirath Pakawachkrilers, an e-commerce specialist and the managing director of Joyfulness Co.

With the tight competition in each market, it’s quite interesting to see how the e-commerce market in each country will play out in 2018. But one thing’s certain: consumers in each market will benefit from this stiff competition because not only do they have more options but also expect more product and service quality.

Thai people engaged with E-Commerce Facebook Fan page

iPrice collaborated with Socialbakers, a leading company in social media analytics, to study the social media engagement of people toward e-commerce Facebook pages in each country.

The study shows Thai people have the highest interaction per 1K fan, garnering a score of 237.6. This is followed by Vietnam with 208.9, and Malaysia with 109.

The data above implies that Thai people are more engaged with content on e-commerce Facebook pages. They tend to like, share, and comment on the post more than people in the other two countries.

Methodology :

- iPrice collaborated with Socialbakers to study the social media engagement of people toward e-commerce Facebook pages in Thailand, Malaysia and Vietnam.

- Interaction per 1K fan is the sum of interactions (likes, comments, and shares) divided by the number of fans, on the day of the post, and multiplied by 1000.

- The data was gathered from Q3 2016 – Q3 2017.

Lazada has become the top choice among online shoppers in Thailand, Malaysia, and Vietnam

Lazada has been operating in Southeast Asia for around 5 years. With the big investment from Alibaba in April 2016, Lazada has become the top choice among online shoppers in Southeast Asia, especially in Thailand, Malaysia, and Vietnam. This is based on the Map of E-Commerce, revealing the ranking of top e-commerce stores in each country by the share of traffic.

In Thailand, Lazada has a traffic share of around 52.6%, followed by 11 Street with 12.2 %, and Shopee with 4.4%. Meanwhile, the Malaysian market is dominated by Lazada with a traffic share of around 48.5%, followed by 11Street with 16.4%, and Lelong with 10.5%.

For Vietnam, although Lazada is ranked first on the list with 19% share of traffic, the total traffic is diversified by many local players such as Thế giới di động with 15% and Sendo 11%.

For Thailand and Malaysia, where Lazada leaves a huge gap for the runner up, consumers have few quality options and they are bound to purchase from the giant. It is quite interesting to see how the other merchants pull together the strategy to gain the share in the upcoming years.

Unlike Vietnam, Lazada’s traffic and the runner’s is only 4% different. It only proves that there is a tight competition between the players and consumers are better off due to higher quality of products and services they have to offer.

Methodology :

- The data was gathered from the Map of E-Commerce-Thailand, Vietnam, Malaysia, which is an interactive content ranking top e-commerce merchants in each country by using different parameters including traffic, social media followers, and app downloads.

- The share of traffic was calculated by the company’s traffic divided by total traffic by all e-commerce on the list.

- The result was from the analysis of 38 e-commerce merchants in Thailand, 62 in Malaysia and 50 in Vietnam.

Consumer preferences in Thailand, Malaysia, and Vietnam

Information Search and Purchase Decision

According to the study, the availability of information varies in each country. Malaysians tend to find more information about promotions and deals, 56% of Malaysian look for promotion while 50% of Vietnamese and 37% of Thai do so. On the other hand, Vietnamese tend to find information about price and availability of the product, 66% of Vietnamese look for information about price while 65% of Malaysian and 51% of Thai have the behavior.

Thai look for information through online channels often they still shop in brick and mortar such as department stores

The research from consumer barometer shows 65% of the Thai respondents accepted that they behaved according to the previous statement while around 50% of Malaysian and Vietnamese agree they had the behavior.

There are many factors to explain this behavior, as an example – Thai people do not trust online shopping system, since they wouldn’t be able to touch and try the products before they make a purchase. Not to mention, they feel more comfortable to have a representative to assist them in their purchase.

International Purchase

International purchase becomes a primary choice for Southeast Asian customers who seek for more options outside their region. Vietnamese people purchase products internationally because they believe that products abroad have higher quality than the one produced in Vietnam, 54% of the respondents agree with the statement.

Thai people also like to purchase products from international companies because of the vast selection of products they offer. They also believe that ordering products online from international companies are cheaper than those sold in their local department stores.

One of the obstacles that these shoppers face is language barrier. This problem seems to be evident among Thai and most especially Vietnamese. This is because they are not comfortable in navigating through an online website that uses English. On the other hand, Malaysians who often use English in their daily conversation, do not experience such problem when purchasing products online from aboard. There is only 3% of Malaysian who reported that language is a challenge for online shopping.

Methodology :

The data was taken from the consumer barometer with Google, in which the data in the Consumer Barometer is pulled from two sources – the core Consumer Barometer questionnaire, which is focused on the adult online population, and Connected Consumer Study, which seeks to enumerate the total adult population and is used to weight the Consumer Barometer results. In this study, the data was selected to compare the data between 3 countries: Thailand, Malaysia and Vietnam.

Source: thailand-business-news.com

Leave a Comment