AS the policymakers continue to review the contentious DNB’s 5G rollout model, it is crucial to unpack DNB’s big promises and premises critically, truthfully, and structurally.

EMIR Research, in its’ own review, already questioned very seriously DNB’s ability to provide lower costs (refer to “Malaysian 5G Rollout: Camouflaged Costing Acrobatics”) and dispelled its ability (and even the intention in the first place) to solve digital divide (refer to “Malaysian 5G Rollout: Digital Divide Whitewash”). Among other things, EMIR Research highlighted big red flags in DNB’s governance structure (refer to “Malaysia’s 5G Rollout: Corporate Governance with Audacity of Impunity!”).

In this article, EMIR Research would like to focus on DNB’s “supply-driven” innovation (or we should say “negative innovation” of a kind) coupled with aggressive spectrum monetization that has simply too far-reaching devastating implications for our nation beyond just losing scarce financial resources and therefore must be addressed decisively and quickly.

We already have seen how DNB has been recently changing their tune with its “solving digital divide” agenda transitioning from one of the key objectives to another initiative that “can be pursued independently” (refer to DNB’s joint report “An analysis of EMIR’s “Reviewing contentious DNB’s 5G”, pp. 2 – 3).

Now, after two years of shouting out loud that Malaysia needs 5G nationwide and fast, DNB proponents finally admit what they used to deny (probably to make a case for their “supply-driven” model)—“5G is an enterprise application with no known killer apps for retail use (at least till today)” (refer to “The context of how and why the 5G Single Wholesale Network model was chosen in Malaysia – Why government-owned DNB is best option to drive 5G SWN” by Tong Kooi Ong in TheEDGE). EMIR Research has emphasized this since day one in its call for a more efficient and gradual or common-sense 5G rollout in pace with the demand and actual use cases.

But now portraying the Malaysian Mobile Network Operators (MNOs) as “bad guys” comes to the forefront again in DNB’s narratives to advance the idea that they would not be willing to put up 5G infrastructure due to intrinsic desire “to sweat out the assets where they have already put a lot of investments into, the 4G infrastructure”.

The same five-page TheEDGE advertorial reads: “The existing MNOs had indicated that they did not plan to roll out 5G at least until 2024”, which, at the very least, is an overstretched misrepresentation.

Reportedly, most Malaysian MNOs have started carving out significant investments in making their base stations 5G-ready in early 2019, in pace with the globe. In the telecom industry, where, like in any IT industry, progress and innovation and, therefore, the cost de-escalation is so fast, only a fool will make an investment in technology planned for use not earlier than five years down the road—yet, another reason why it is unwise to be locked in 10 years agreement with one vendor like under current DNB’s arrangement.

However, what did not happen at pace with the globe was the 5G-spectrum auction by the Malaysian government. Instead, even the technology neutrality for the spectrum (the right to use their existing spectrum to provide 5G service) was unexpectedly revoked, which is one gross violation of the key principle of using the scarce spectrum efficiently to generate maximum benefits for society! After all, using legacy spectrum, MNOs could bring 5G to at least 5G-commercially viable areas (those industrial areas) long ago, even without spending astronomic amounts on new spectrum bands.

So it is starting to look unclear who really had a sinister intention to “sweat out” the spectrum price! All those loud concerns (by the DNB advocates) about the costs to MNOs, which would implicate rollout speed and prices to the end-users, begin to look like yet another whitewash re-affirmed when we unpack properly misleading graphs in the same five-page TheEDGE advertorial.

“Malaysian mobile consumers are paying one of the highest rates in the Asean region”— one of the graphs reads while stating the source as “DNB analysis” (Diagram 3). Another graph (Diagram 4) tries to portray our MNOs as holding out on investments into network upgrades resulting in poor quality, among other things, according to the advertorial narrative. However, the graph compares apples and oranges using 5-year averages while ignoring that the regional MNOs are already 2 to 3 years into their 5G rollout upon purchasing new spectrum bands, unlike their Malaysian counterparts and, therefore, have very different cost structures.

Nevertheless, publicly available global data points indicate that DNB’s paintings are over-sin-sensationalized at the very least.

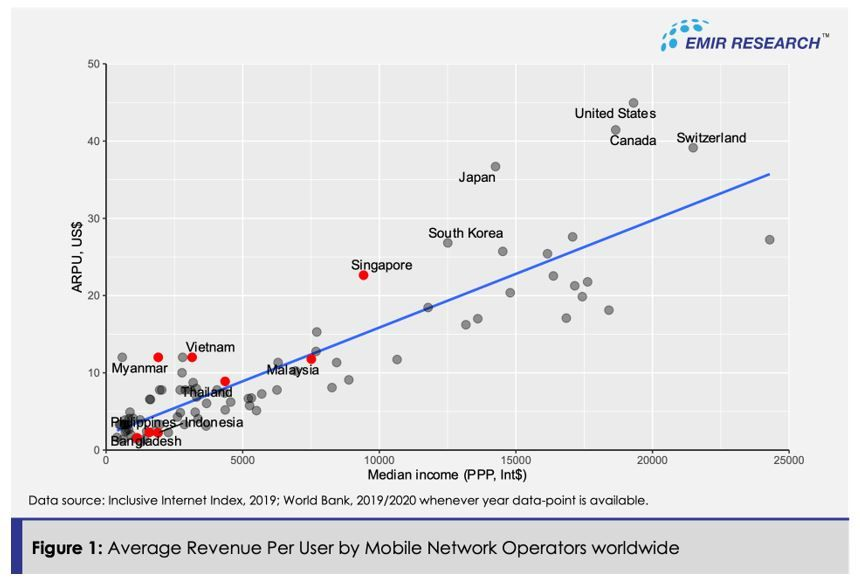

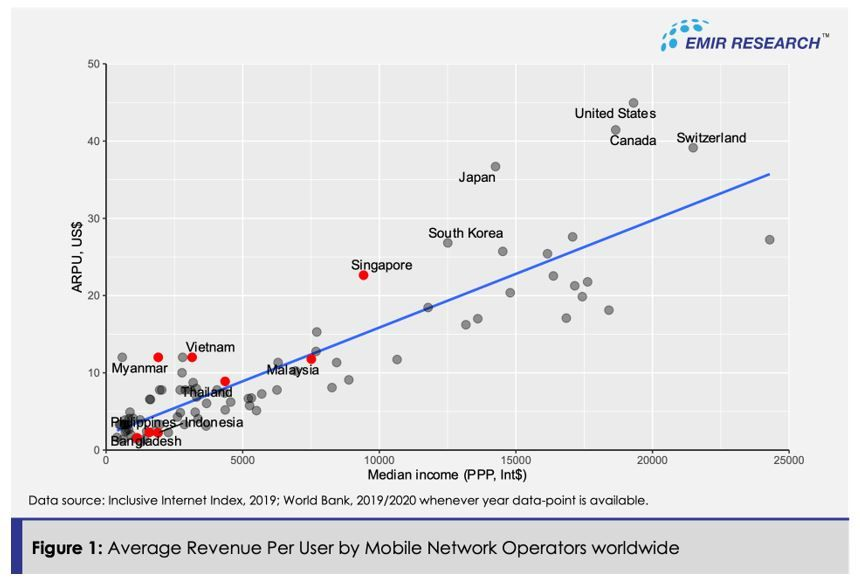

For example, when we unpack Diagram 3, replacing GDP per capita with median income (a less misleading, even though still a rough proxy of disposable income), we will see a clear manifestation of the fact that what MNOs can charge in their local markets is very much determined by what people can spend (Figure 1).

Figure 1 data is intentionally for 2019 as a 5G-sunrise year to ensure comparability among the countries. The trend line in Figure 1 illustrates which markets have balanced ARPU and median income. As we can see, ARPU for Malaysian MNOs is at par with the regional peers.

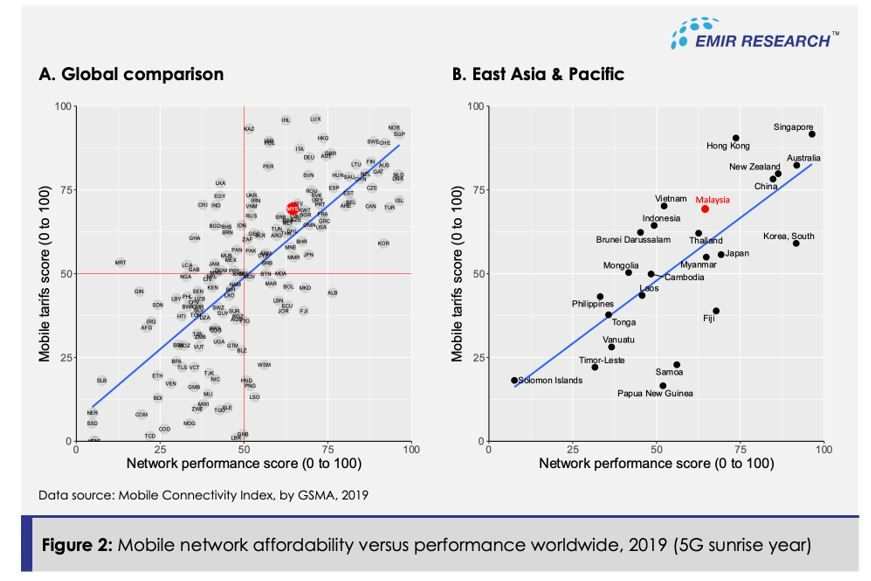

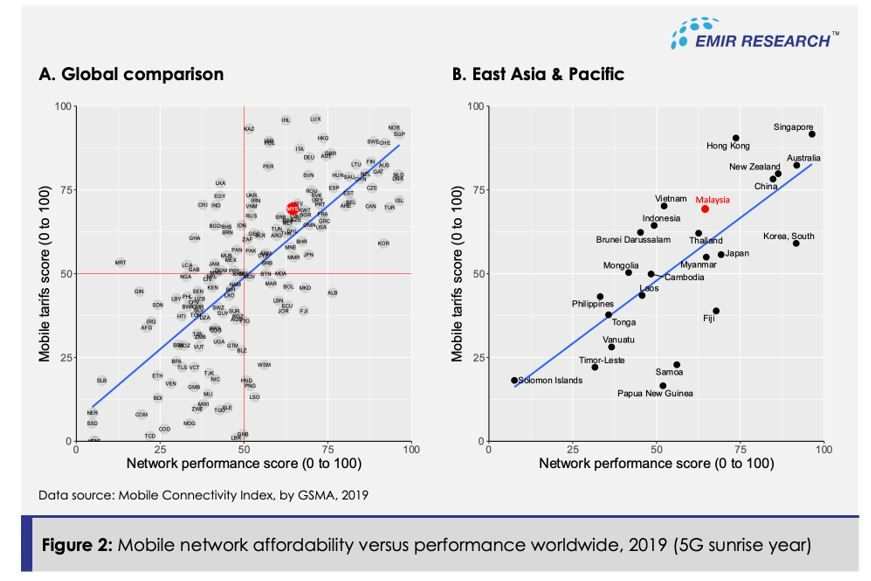

Figure 2 is a visualization based on another credible global index, the Mobile Connectivity Index by GSM Association. We see an expected solid positive relationship between network performance and mobile tariff affordability worldwide. And, again, as of 2019 (just before the DNB’s saga), Malaysia was not only ahead of its most regional peers (Figure 2B) but the majority of other middle-income nations (Figure 2A).

Of course, it is a reasonable question—could we have done better like those countries in the extreme top right-hand corner of Figure 2A?

We probably could if there were common-sense policies by the previous administration, particularly in handling spectrum efficiently.

Yes, the spectrum can generate state revenues. However, accumulated empirical evidence conclusively shows that excessive spectrum monetization by the government costs times more to the broader economy (specifically the digital economy) than it raises in additional state revenues. Moreover, it costs even more to the social welfare of countries with large differentials in consumers’ spending power—the category Malaysia certainly belongs to.

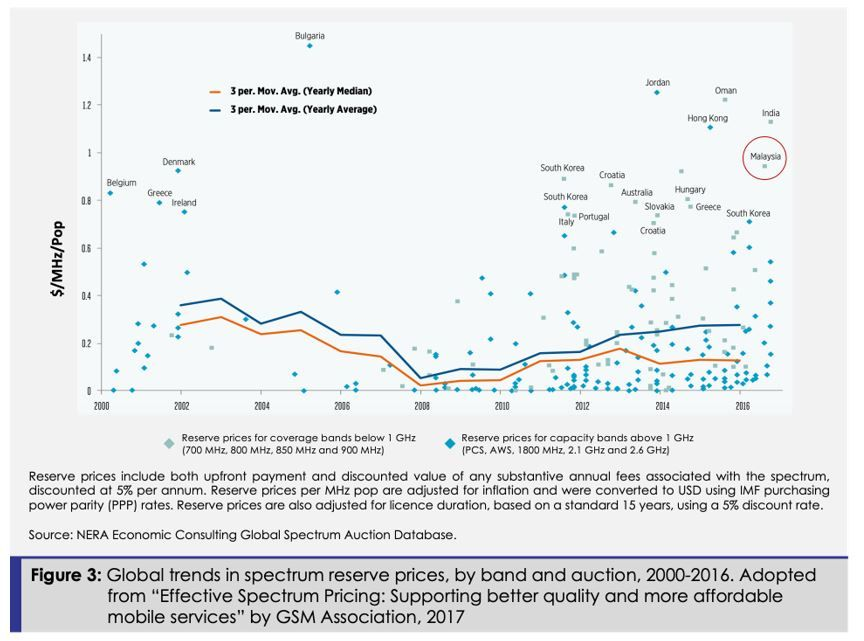

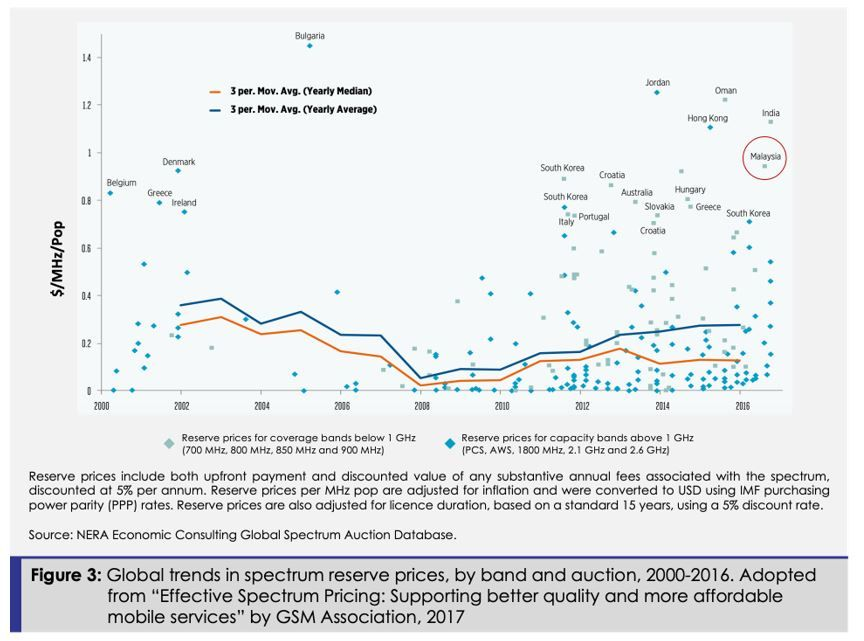

For example, “Effective Spectrum Pricing: Supporting better quality and more affordable mobile services”, using data from NERA’s database of spectrum awards, finds statistical evidence linking higher spectrum prices to low investment in 4G and higher consumer prices for data which is consistent with other empirical evidence reviewed in the paper.

Numerous visualizations of NERA’s data in the same paper also reveal Malaysia among those with unduly high spectrum pricing. For instance, Malaysia’s spectrum reserve prices for coverage bands appear prohibitively too high (Figure 3), which contradicts our policymakers’ long-standing “jihad” to close the digital divide.

What more could we expect when, under DNB’s very “innovative” model, spectrum fees will now directly impact MNOs’ marginal costs??? This will have a pure deadweight loss tax effect on our digital economy, leading to its significant shrinkage.

Furthermore, according to analysis using “order of magnitude” estimates, spectrum costs create a more significant deadweight loss to the social welfare than even general taxation (refer to research work “What really matters in spectrum allocation design”).

In the context of the above, is outright disgusting how DNB’s proponents are trying to justify their existence with their bravado projected cash flows which are also just a miserable fraction of what MNOs can deliver in Universal Service Provision fund, taxes, and dividends to Government-Linked Investment Companies.

From Figure 3, we also notice spectrum prices have plateaued since 2013, which could be partly explained by the reduced spectrum scarcity due to legacy-spectrum re-farming possibility. Or, perhaps, this is due to accumulated global wisdom from the previous spectrum revenue extraction fiascos. After all, given the above empirical evidence, we should expect that the “countries that try to resist this trend, either by restricting spectrum availability or overpricing newly released spectrum, are likely to find themselves falling even further behind in availability and take-up of next generation data and associated connectivity services”.

This is why for the 5G rollout, many regulators worldwide strongly prioritize benefits to the broader digital economy over short-term windfall for their treasuries.

For example, in countries like China, Germany, Japan, New Zealand, Qatar, Sweden and many others, 5G-applicable spectrum is even given either at no costs but via a competitive tender or with no up-front costs and postponed by a few years and gradually increasing thereof annual fees or in some other variation to significantly relief MNOs’ cashflow difficulties and risks. European Commission in their Connectivity Toolbox, a set of best practices for timely rolling out 5G, specifically emphasize the importance of finding ways to lower the recurring costs of spectrum for MNOs especially “where the prospect of a substantial densification of the network is foreseen in the longer term”.

Malaysia has been far too often in the anti-trend and negative-innovation zone for the last two decades. This is high time to reverse it, at least, for our digital economy.

DNB has already created a lot of mess and social welfare losses, many of which, sadly, will go unestimated. Still, policymakers should no longer allow it to thwart our digital future. We can immediately turn this miserable situation around by restoring our spectrum efficiency.

Leave a Comment